amazon flex quarterly taxes

Thats why employers are responsible for withholding taxes from their employees paychecks and depositing those funds with the IRS. We would like to show you a description here but the site wont allow us.

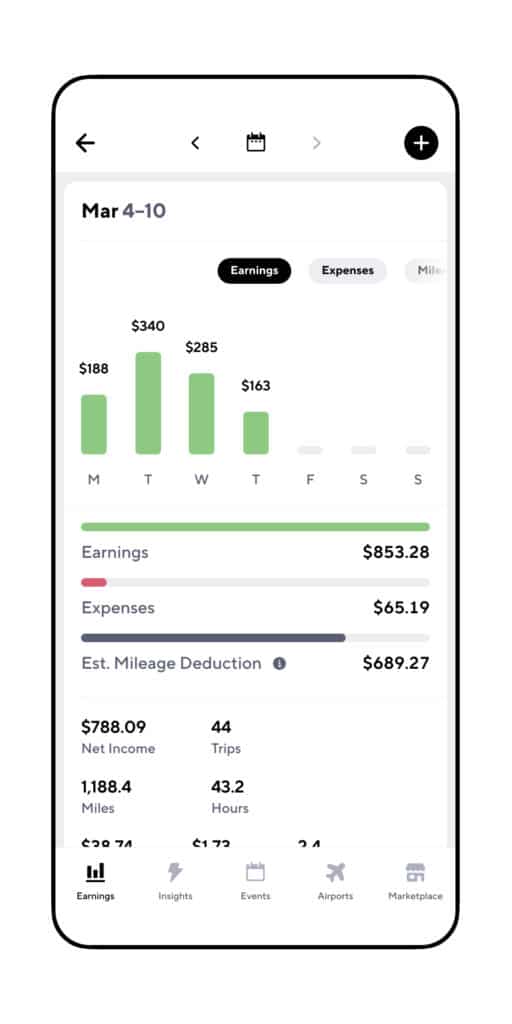

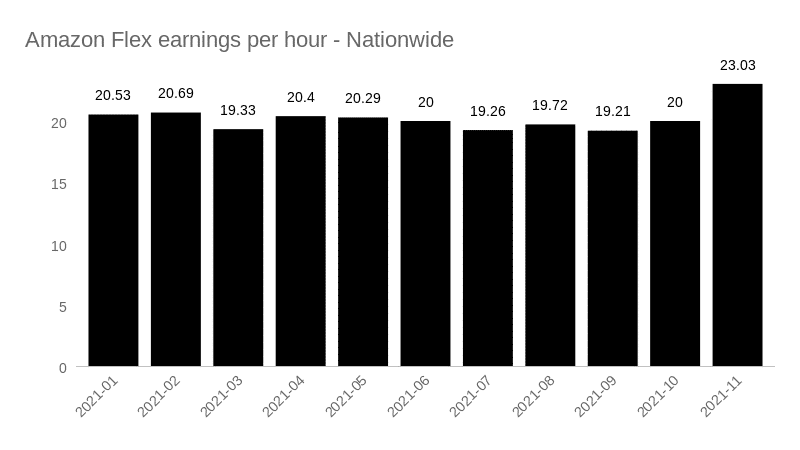

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

You can even pay your taxes with Paypal for a fee and net some profit or send money to a friend and net a little.

. Activate Offers Suggestions FreedomFlex Discover Dividend Cash more. The 20-1 stock split goes into effect today June 6. Were talking about estimated taxes also known as quarterly taxes because you pay them four times a year.

No annual fee. For Fidelity funds holdings are updated on a calendar quarterly basis. For the supply of Spodumene concentrate from Piedmonts North Carolina deposit to Tesla.

Its a problem for more and more taxpayers as people shift toward freelance and gig economy jobs. FLEXSTEEL INDUSTRIES INC. Gore and Associates Inc Avient Corporation Raumedic AG and others -.

Fidelity Flex International Fund. Youll need to declare your Amazon flex taxes under the rules of HMRC self-assessment. Shares were worth 2785 at the time of the announcementthats.

Current value of the DashPass membership is as of 04012022. The company reported during their September 2020 quarterly report a signed binding agreement with Tesla Inc. Long story short the US has a pay-as-you-go tax system.

5259 of Total Portfolio. Quarterly twice per year or annually depending on the total amount of sales tax you collect. AMZN announced its first stock split since 1999.

Why are quarterly taxes required. Membership must be activated. Hotel and motel rooms.

Youll need to submit a tax return online declaring your income and expenses once a year by 31 January as well as paying tax twice a year by 31 January and 31 July. Before Taxes Return before taxes is a measure of a funds performance over a given time frame before accounting for the. Fidelity Flex Large Cap Growth.

SBLK real-time quote historical performance charts and other financial information to help you make more informed trading and investment decisions. For Fidelity funds holdings are updated on a calendar quarterly basis. Medical Tubing Market US 79 Billion by 2026 at a CAGR of 100 Saint-Gobain Freudenberg Medical LLC WL.

Before Taxes Return before taxes is a measure of a funds performance over a given time frame before accounting for the. Q3 2022 5 Quarterly Categories. 3466 of Total Portfolio.

FLXS-157 Q4 2022 Earnings Call Aug 23 2022 900 am. Shares of Flexsteel gained 1456 to 1959 on Wednesday. What overpaying means for your estimated taxes.

You can generally take a deduction for all mileage while you are active on the Uber platform or other platforms like Amazon Flex. This includes when you have a fare in your car driving to pick up a fare and driving around trying to find a fare. Earlier Wednesday CSC Chairman Justin Yoshimura issued a.

It includes rentals of. 5 Cash Back in quarterly bonus. A short-term or transient rental is a rental period of six months or less.

Deadlines for Quarterly Estimated Taxes. What counts as a short-term or transient rental. Theres one scenario where you might easily overpay your taxes.

Activate to earn 5 Cashback Bonus at Restaurants and PayPal from 7122 or the date on which you activate 5. Earn a 200 bonus after spending 500 on purchases in the first 3 months from account opening. That puts total sales taxes on short-term rentals at around 6 to 14.

Action Needed 2021 Tax Year 2022 Tax Year. Get the latest Star Bulk Carriers Corp. Including service fee taxes and gratuity on orders may apply.

Year to date the stock is down 27 with a market cap of nearly 110 million. Earn 5 cash back on up to 1500 in categories that rotate quarterly. If youre self-employed and have enough taxable income your quarterly payments essentially take the place of that withholding.

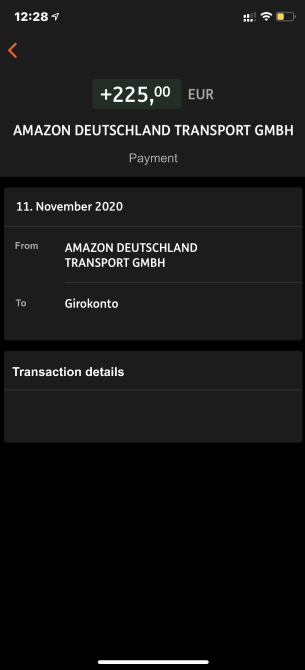

Tax Returns for Amazon Flex.

How To File Amazon Flex 1099 Taxes The Easy Way

How To Make Profit With Amazon Flex In 2022

Amazon Flex Taxes Documents Checklists Essentials

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Flex Driver Pay Q1 2022 What Is Amazon Paying Their Drivers Gridwise

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Get More Amazon Flex Blocks 6 Best Tips For Drivers

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How Much Do Amazon Flex Drivers Make Gridwise

How To Do Taxes For Amazon Flex Youtube

How To Get More Amazon Flex Blocks 6 Best Tips For Drivers